The need to ramp up cybersecurity and fraud detection efforts is now a necessity for any bank or financial institution, and AI plays a key role in improving the security of online finance. Workiva offers a cloud platform designed to simplify workflows for managing and reporting on data across finance, risk and ESG teams. It’s equipped with generative AI to enhance productivity by aiding users in drafting documents, revising content and conducting research. The company has more than a dozen offices around the globe serving customers in industries like banking, insurance and higher education.

Data availability

The platform utilizes natural language processing to analyze keyword searches within filings, transcripts, research and news to discover changes and trends in financial markets. Taught by a diverse staff of world leading academics and practitioners, the AIFI courses teach both the theory and practical implementation of artificial intelligence and machine learning tools in investment management. As part of the program, students will learn the mathematical and statistical theories behind modern quantitative artificial intelligence modeling. Our goal is to train investment professionals in how to use the new wave of computer driven tools and techniques that are rapidly transforming investment management, risk management and capital markets.

AI and investor sentiment analysis

Concerning the geographic dimension of this field, North America and China are the leading investors and are expected to benefit the most from AI-driven economic returns. Europe and emerging markets in Asia and South America will follow, with moderate profits owing to fewer and later investments (PwC 2017). Enova uses AI and machine learning in its lending platform to provide advanced financial analytics and credit assessment. The company aims to serve non-prime consumers and small businesses and help solve real-life problems, like emergency costs and bank loans for small businesses, without putting either the lender or recipient in an unmanageable situation. By assembling a faculty comprised of the rare breed of academic thought leaders and practitioners of AI in finance, supplement with other global thought leaders in AI, AIFI seeks to help students use these cutting edge tools effectively in their investment careers. The certificate will demonstrate a world class education and competency in what will be the future of investment management that will be revered by investors and asset managers.

The future of your industry starts here.

Fintechs and traditional banking institutions are investing in this technology, and it promises to give them an edge in revenue growth, improved customer experiences, and operational efficiency. When developing AI solutions, you should follow best practices by following frameworks that emphasize identifying desired outcomes, ensuring you have implemented a solid data strategy, and then experimenting and implementing scalable AI solutions. Companies should tie their goals for AI in finance to business problems and identify performance metrics based on these goals. New models are developing rapidly, and companies in the finance industry need to adapt to new technology quickly.

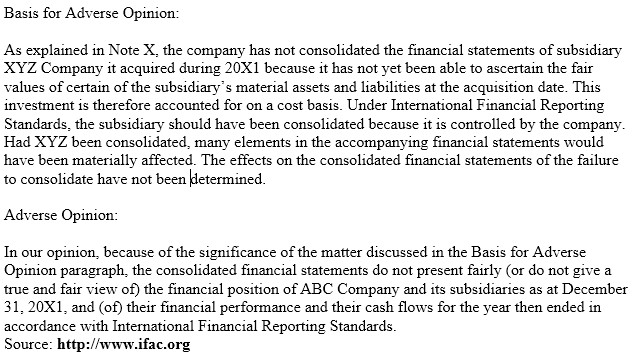

Bank default prediction models often rely solely on accounting information from banks’ financial statements. To enhance default forecast, future work should consider market data as well (Le and Viviani 2018). Fraud detection based on AI needs further experiments in terms of training speed and classification accuracy (Kumar et al. 2019).

With the scope of preventing further global financial crises, the banking industry relies on financial decision support systems (FDSSs), which are strongly improved by AI-based models (Abedin et al. 2019). Utilized by top banks in the United States, f5 provides security solutions that help financial services mitigate a variety of issues. The company offers solutions for safeguarding data, digital transformation, GRC and fraud management as well as open banking. Underwrite.ai uses AI models to analyze thousands of financial attributes from credit bureau sources to assess credit risk for consumer and small business loan applicants. The platform acquires portfolio data and applies machine learning to find patterns and determine the outcome of applications. Robo-advisors are gaining popularity as inflation rates soar, providing a simple and accessible option for passive investing.

He noted the Magnificent 7 stocks are worth a combined $16 trillion — 34% of the S&P 500’s market value, and more than the index’s total value in early 2016. Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services. Opportunities like McDonald’s and the inroads it’s making into other industries and devices outside its core automobile and restaurant verticals can help the stock move from here. While SoundHound has a lot of potential, it still remains a speculative investment, given its valuation and the fact that it is still in the early innings of its growth phase.

- We will discuss a variety of ways any investor can incorporate artificial intelligence into their investing.

- Finally, companies are deploying AI-guided digital assistants that make it easier to find information and get work done, no matter where you are.

- If you’re considering building a game-changing AI solution and don’t know where to start, talk to us.

- Thus, banks must use personalized banking to gain a competitive advantage, improving customer engagement and loyalty.

- To extract relevant insights, They can use models to analyze unstructured data sources, such as news articles, social media feeds, and research reports.

While large language models like OpenAI’s GPT-4 and Anthropic’s Claude work well out of the box, many financial institutions find that they need to customize models to get them to provide the best responses and align with their policies. Techniques like fine-tuning models on proprietary data, prompt engineering, and retrieval help elevate a base model from https://www.business-accounting.net/ acceptable responses to a superior customer experience. Many financial institutions leverage their vast data to offer AI-enabled personalized service and guidance. Institutions can provide customers with assistant-like features, including categorizing expenditures, suggesting savings goals and strategies, and providing notice about upcoming transfers.

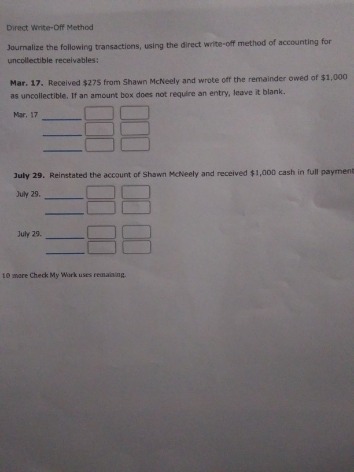

The software allows business, organizations and individuals to increase speed and accuracy when analyzing financial documents. Ocrolus’ software analyzes bank statements, pay stubs, tax documents, mortgage forms, invoices and more to determine loan eligibility, with areas capital budgeting projects nature need and importance of focus including mortgage lending, business lending, consumer lending, credit scoring and KYC. To capture the benefits of these exciting new technologies while controlling the risks, companies must invest in their software development and data science capabilities.

It may not even hurt total headcount, once requisite AI-related management hires are accounted for. “Traditional AI adoption in financial services [is] widespread, shallow, and inconsequential,” Shameek Kundu, chief strategy officer and head https://www.accountingcoaching.online/journal-entries-to-issue-stock/ of financial services at AI observability platform TruEra, wrote in the report. Investment professionals who know how to implement AI tools are in demand, yet there is a gap in training and education for those wanting to enter the field.