If your sales price is too low, you might have to sell too many units to break even. And as much as we think a lower price means more buyers, studies actually show that consumers rely on price to determine the quality of a product or service. What this answer means is that XYZ Corporation has to produce and sell 50,000 widgets to cover their total expenses, fixed and variable. At this level of sales, they will make no profit but will just break even. Now Barbara can go back to the board and say that the company must sell at least 2,500 units or the equivalent of $1,250,000 in sales before any profits are realized.

Break-Even Analysis Chart

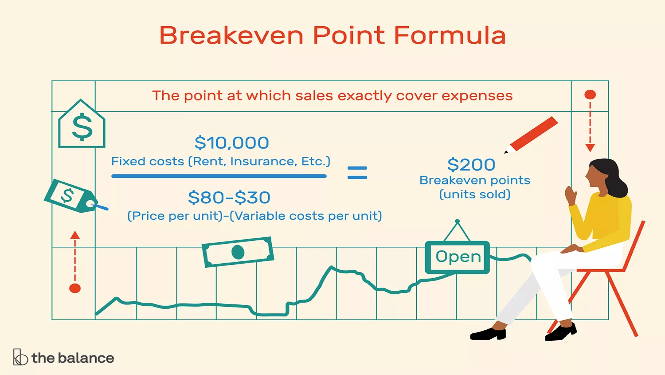

Production managers and executives have to be keenly aware of their level of sales and how close they are to covering fixed and variable costs at all times. That’s why they constantly try to change elements in the formulas reduce the number of units need to produce and increase profitability. The break-even point formula is calculated by dividing the total fixed costs of production by the price per unit less the variable costs to produce the product. It is also possible to calculate how many units need to be sold to cover the fixed costs, which will result in the company breaking even.

How to calculate a break-even point based on units:

When you outsource fixed costs, these costs are turned into variable costs. Variable costs are incurred only when a sale is made, meaning you only pay for what you need. Outsourcing these nonessential costs will lower your profit margin and require you to sell fewer products to make a profit.

- Check out our piece on the best bookkeeping software for small-business owners.

- Use your break-even point to determine how much you need to sell to cover costs or make a profit.

- From this analysis, you can see that if you can reduce the cost variables, you can lower your breakeven point without having to raise your price.

- As the owner of a small business, you can see that any decision you make about pricing your product, the costs you incur in your business, and sales volume are interrelated.

- Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology.

Mitigate financial risks

To find the total units required to break even, divide the total fixed costs by the unit contribution margin. The break-even point can be affected by a number of factors, including changes in fixed and variable costs, price, and sales volume. While the breakeven point is a valuable tool for decision-making, it has several limitations. One major downside is its reliance on the assumption that costs can be neatly divided into fixed and variable categories.

Businesses share the similar core objective of eventually becoming profitable in order to continue operating. Otherwise, the business will need to wind-down since the current business model is not sustainable. If you know your break-even point, you can set targets for growing your business. This is because your break-even analysis shows you at what point your business will realize a profit. It can also help you determine the sales needed to ensure you make a profit.

Our Services

After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. No, the break-even point cannot be used to predict future profits. It is only useful for determining whether a company is making a profit or not at a given point in time. Sales below the break-even point mean a loss, while any sales made above the break-even point lead to profits.

Generally, to calculate the breakeven point in business, fixed costs are divided by the gross profit margin. This produces a dollar figure that a company needs to break even. When it career paths outside of accounting comes to stocks, for example, if a trader bought a stock at $200, and nine months later, it reached $200 again after falling from $250, it would have reached the breakeven point.

If you’re looking for other small business tips and accounting tools, we’re here to help. QuickBooks can assist with tasks from bookkeeping and payroll to inventory analysis and profitability. Contact us today to discover what QuickBooks can do to help you with all of your small business accounting needs. When analyzing your break-even point, not only do you want to see that your business is breaking even, you’re looking to make sure your business is profitable as well.

In corporate accounting, the breakeven point (BEP) is the moment a company’s operations stop being unprofitable and starts to earn a profit. The breakeven point is the production level at which total revenues for a product equal total expenses. The breakeven point can also be used in other ways across finance such as in trading. In contrast to fixed costs, variable costs increase (or decrease) based on the number of units sold. If customer demand and sales are higher for the company in a certain period, its variable costs will also move in the same direction and increase (and vice versa).

For instance, if your restaurant is introducing a new signature dish, you’ll want to know how many orders of that dish you need to sell to cover the costs of ingredients, staff time, and marketing. When starting a new business, this analysis can help you find out if your business idea is financially viable before you invest too much time or money. For example, If your startup costs are $50,000 and your product sells for $50 with a $20 production cost, break-even analysis shows you’ll need to sell roughly 1,700 units to cover your expenses. From there, you can decide on pricing, production, and sales targets so your business can stay on the right track from the get-go. A contribution margin formula is a useful tool that you can use to plan sales and costs of sales.