Conditions do change from a demo to a live account though, so take that with a pinch of salt. BlackBull Markets CFDs are offered on forex, stocks, indices, commodities and cryptos with tight spreads and high leverage. The ECN accounts offer fast execution and low slippage, and the broker provides traders with plenty of extra tools and features plus 24/7 customer support.

BlackBull Markets Spread

- The entry barrier is low, trading costs are affordable and funding is fast and hassle-free.

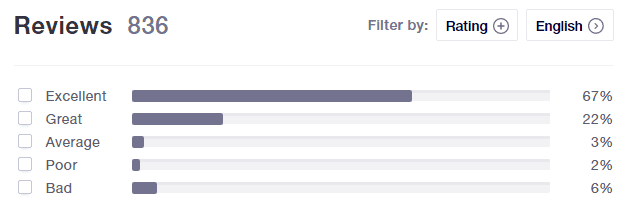

- Labeled Verified, they’re about genuine experiences.Learn more about other kinds of reviews.

- The videos have depth and cover both fundamental and technical analysis topics in a comprehensive manner.

- We tested two deposit and withdrawal methods and found that the broker charges a fee on Credit card deposits, but Neteller deposits are free.

Compared to the industry average, BlackBull offers an average amount of FX pairs and commodities, and a high number of share CFDs, indices, and cryptocurrencies. The market is volatile and ever-changing, and staying on top of the latest developments is made easy with BlackBull’s mobile app. It can also be used to place market, limit, and stop orders, as well as to adjust the exposure of open trades. It facilitates technical analysis by providing an overview of price action behavior.

Who Are BlackBull Markets?

It appears that BlackBull Markets does not offer it, making highly leveraged trading an especially high-risk approach with this broker. I searched their legal documents, but none confirmed the existence of negative balance protection. However, from a regulatory perspective, I can strongly recommend this broker. https://forexbroker-listing.com/ From a security perspective, client deposits remain well-protected, but I cannot ignore the absence of negative balance protection, particularly for leveraged trading accounts. BrokerNotes.co provides unbiased forex broker reviews and ratings to help traders and investors find the best broker for their needs.

All Trading Platforms

This combination of educational content and practical trading tools makes BlackBull Markets a strong broker for both learning and trading in various financial markets. For self-help resources, their website features a comprehensive FAQ and glossary section, offering detailed information about forex and CFD trading and the broker’s specific services. BlackBull Markets offers a range of fee-free funding methods while requiring no minimum deposit to start trading. BlackBull Markets offers a diverse range of trading platforms to suit various trading styles and preferences, including MetaTrader 4, MetaTrader 5, cTrader, TradingView, BlackBull CopyTrader, and BlackBull Shares. The broker offers the economic calendar; it is a useful trading tool that shows the schedule of future market events and their expected impacts on the financial markets. MetaQuotes power the economic calendar widget on the BlackBull Markets website.

Forex Trading Apps

The platform offers near-instant execution speeds, interactive charts, and direct market trading using prime liquidity providers. The platform supports Expert Advisors (EAs), as well as MetaScripts, which allow you to create your own automated robots. CTrader is probably one of the most well-rounded platforms out there.

To evaluate brokers, we test the accounts, trading tools and services provided. Over 100 data points are considered, from minimum deposits and trading fees to the platforms and apps available. Our broker ratings are also informed by the experience of our researchers during the evaluation process. We also take an in-depth look at each broker’s commissions and fees, such as bid/ask spreads – including the average spread data for some of the most popular forex currency pairs.

Is IC Markets or BlackBull Markets safer for forex and CFDs trading?

Both brokers offer exceptional support, but Pepperstone takes the lead in this category. Taking into account the overall account offerings and the specific features of the Islamic accounts, Pepperstone’s Razor account and broader regulatory oversight give it an edge. However, BlackBull Markets’ comprehensive Islamic account offering makes it a strong contender for Muslim traders. Blackbull blackbull markets review Markets also offers ZuluTrade and HokoCloud, while Pepperstone offers Pelican social trading in the UK and Europe and DupliTrade for copy trading to traders outside the UK and Europe. The broker provides instant execution and allows scalping and hedging strategies. BlackBull Markets’ customer service team was quite helpful and gave us direct and prompt answers that were very accurate.

Copy trades or lead followers with the BlackBull CopyTrader platform. Use our international search tool to find a broker that accepts clients from your country. On the other hand, Pepperstone delivers the $0 minimum across all regions and methods of payment.

However, the bulk of BlackBull Markets’ tradable symbols are equities. Yet another great thing about cTrader is that it has many built-in videos explaining what its multiple technical indicators do and how they can be used in real-world trading. This feature is great for beginners who still haven’t fully developed their trading systems. This configuration is fine for intraday trading but less ideal for longer-term strategies, such as day trading and position trading. The values listed below are for one full contract (100,000 units) of the base currency. BlackBull Market is a legit broker regulated in New Zealand, the UK, and Seychelles with an exceptional regulatory track record.

BlackBull Markets charges other non-trading fees, including deposit and withdrawal fees. The deposit went through within less than 5 minutes, with absolutely no hassle or fees. I tested a second deposit on the weekend to see if the deposits were being manually verified, however the deposit went straight through on the weekend too within less than 5 minutes, which is great! The International Bank Transfers do take between 12 and 72 hours, which still is very competitive to other brokers as this is generally how long international transfers take to complete. You can download BlackBulls own MT4 platform from the client area once your account is setup – from there you login using your MT4 details and you will instantly be able to start placing trades.

The broker does not charge a handling fee for deposits, however, a $5 fee is applied to withdrawals. I appreciate the flexibility at BlackBull Markets for deposits, as after the initial deposit, follow-on amounts remain at the discretion of traders. Another positive is that traders may deposit in nine currencies, but not all deposit methods support each of them.

That is why traders need to familiarize themselves with the safety mechanisms ensured by the entity they want to open an account with beforehand. Its standard pricing package (floating spreads and zero commissions) meets the industry average, with more favorable prices available on BlackBull Markets’ Prime account. BlackBull allows traders to deposit any amount they wish following the initial minimum deposit.

Opening an account at BlackBull Markets is acceptably quick and follows the normal standard in the retail Forex industry. I found some of the additional questions unnecessary, as traders can fill them out as they wish, and there is no verification of the answers. BlackBull Markets includes the account verification with the account opening form, which I like, as it is a requirement and saves traders the extra step from the back office. New traders must submit a copy of their ID and a proof of residency document dated within the past three months. BlackBull Markets answers some questions in its FAQ section and describes its products and services well. Therefore, I believe that most traders will not require assistance unless there is an emergency.

BlackBull Markets is a multiple award-winning New Zealand-based forex and contract for difference (CFD) broker with over 26,000 tradable instruments, including equities, cryptocurrencies, indices and commodities. CFD trading lets you profit from rising and falling markets by entering into contracts with a broker to exchange the difference in an asset’s value between the opening and closing of the trade. When trading Contracts for Difference (CFDs), positions can be opened for a fraction of their value because of the leverage. Essentially, the broker lends the trader money so that the latter can open bigger positions. The leverage multiplies the profits a trader generates from winning positions but also the losses incurred from failed trades. BlackBull Markets also provides FIX API and Virtual Private Server (VPS) hosting for low-latency trading, mitigating the risk of negative slippage.

If you’re a beginner, consider using MT4 till you become very comfortable using advanced trading platforms like cTrader. The MT4/MT5 suites are versatile and well-recognized in the financial market. Their extensive features and functionalities establish them as the ideal online platform for CFD and forex trading.

To qualify for a free VPS at BlackBull Markets, traders are required to open a Prime account with a minimum deposit of $2,000 and maintain 20 lots of trading volume per month. As a true ECN broker, BlackBull Markets operates the Straight Through Processing execution model, which offers access to the interbank markets without the intervention of a dealing desk. The broker offers its services to tens of thousands of traders from over 180 different countries. BlackBull Markets has a few competitors, including XM, Pepperstone, FXCM and Admiral Market. Like BlackBull Markets, these brokers provide multi-asset CFD trading to institutional and retail investors.